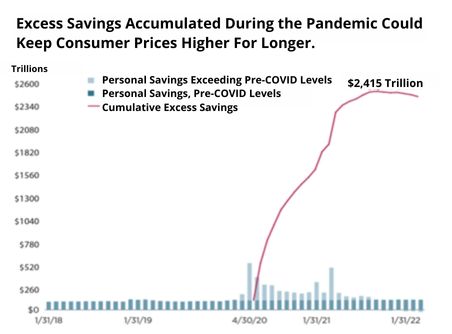

According to research statistics from Fortune.com, consumers right now have an extra $2.5 trillion, collectively. While this sounds like a good thing, it could keep prices higher for longer.

Confidence in younger consumers has risen to the highest it’s been since last June, but confidence in older consumers fell in May to the lowest level since February 2021. Rising prices especially impact those on fixed incomes as inflation takes a larger bite out of retirees. Larger ticket items such as automobiles and homes are steady, which tells us that the consumer sector is fairly stable; it appears that the economy will most likely avoid a recession in the near term as the Fed navigates a “softish” landing.

‘Excess savings’ is a term used to represent all the extra money that consumers have put away (on top of what they were projected to accumulate at the rate of saving before the pandemic) thanks to a combination of things, such as limited spending options, government financial assistance, and a run-up in home values and prices of stocks.

This generally sounds like good news, especially for investors in companies that have been passing their heightened costs along to their customers in the form of higher prices. If customers can’t afford to pay up in situations like this, then raising the prices would be significantly more risky and cause demand to decline, causing inflation to correct itself, in a way – that’s the law of supply and demand! The ‘problem’ with all that is unfortunately for us consumers, that’s not happening, and the high prices are failing to slow demand.

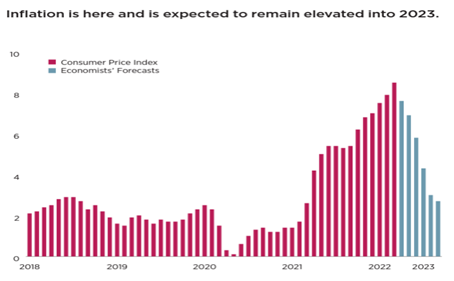

What it means: As the Fed continues to hike up interest rates in an effort to bring the inflation down, it’s going to be quite a ride. It’s wise to continue to save for a rainy day, especially when a rise in prices on food, gas/ diesel, and other larger ticket items appears to be on the forefront of the future. In short, the curve on inflation appears to be headed towards a “cool-down” period but will stay of top concern regarding planning for the near term.