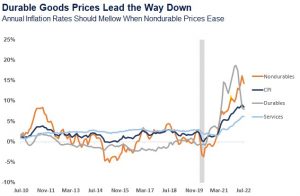

Headline CPI eased in July to 8.5% year-over-year from 9.1% in June. Still above the Federal Reserve’s (Fed) long-run target rate, the annual rate of inflation seems to be cooling. As shown in the chart below, inflation is easing as durable goods prices continue their descent from recent highs. For example, prices for appliances have declined for three out of the last four months and used vehicle prices declined four out of the last six months. “The July inflation report should change market expectations about future Fed activity,” explained Jeffrey Roach, Chief Economist for LPL Financial. “As inflation eases, the Fed can now tighten monetary policy at a slower pace.” The Fed still has a lot of work to do, but pricing pressures seem to be easing.

The latest inflation report is welcomed by our advisors here at InVestra and could add support for the Fed to raise rates at a slower pace in September. However, the headline measure of inflation may be too good to be true because of the nagging price increases to rental costs.

Watch Out for Rent

Recent pricing trends for rent of primary residence is alarming. Since November 2020, monthly changes in rental costs have accelerated. Last July, rental costs rose 0.2% month-over-month and then inched up to 0.7% month-over-month in July 2022. The booming housing market explains most of the rise in rental costs. During the recent period of unusually low mortgage rates, housing demand skyrocketed and home price appreciation reached new levels. High housing costs pushed many homes out of reach for would-be millennial buyers and for first-time buyers with no pre-existing home equity. High demand for homes and low supply created insurmountable hurdles and pushed many to be renters instead of home buyers.

Fed Could Hike 50

As inflation rates slow, the Fed could revert to a 50 basis point (or 0.5%) increase at the next meeting of the Federal Open Market Committee (FOMC) in September. Inflation is the primary concern for policymakers. Although the employment situation is the other mandate for the central bank, inflation is currently the greater risk. The labor market is a key variable for investors as they anticipate future moves by the Fed. A slowing job market is a risk, especially since firms are announcing more layoffs. For more on the labor market and its relationship with Fed policy, be sure to watch our latest Econ Market Minute, where Chief Economist Jeffrey Roach gives more economic insights.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks .

All information is believed to be from reliable sources; however,InVestra Financial Services makes no representation as to its completeness or accuracy.

Securities and advisory services are offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Tracking # 1-05313912