From Heavy Highway Congestion to Eerily Empty Roadways

Not to play up too much on the data from the National Association of Home Builders (NAHB) but the NAHB gives insights on the traffic of prospective buyers, a leading indicator of future activity. Not surprising but definitely troubling, traffic fell to the lowest level since May 2020 and suggests that the housing market has more downside to go as interest rates trek higher and inflation chisels away consumer purchasing power. Since mid-2020 until recently, we saw heavy congestion as housing traffic was too high and extraordinary demand pushed up selling prices to unstable levels, a consequence of ultra-loose monetary policy. Now, as the Federal Reserve (Fed) tightened policy and mortgage rates rose, traffic cleared up. But, is the decline in prospective buyers too ominous? Not likely in our view. Rather, the market is returning to levels reached in 2019.

“We have not likely reached the bottom in the housing market but as of now, we are not making the apocalyptic case that housing is going to crash,” – Jeffrey Roach, Chief Economist of LPL Financial

Source: Natl Assc of Realtors, RedFin 7/22/22

Source: Natl Assc of Realtors, RedFin 7/22/22

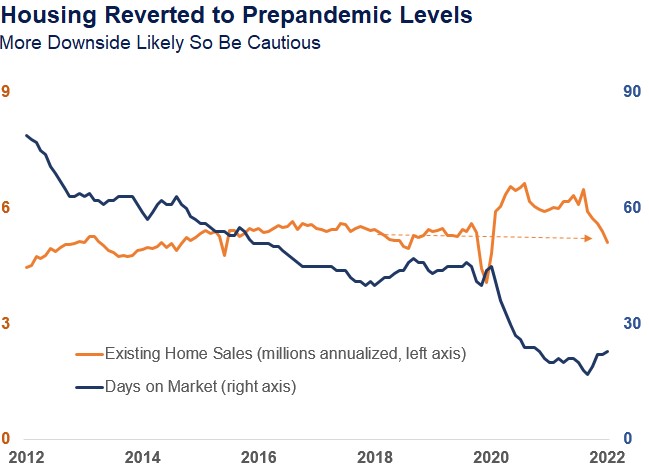

As shown in the LPL Chart of the Day, the current pace of home sales has reverted to the pre-pandemic pace. Although the outlook seems bleak, a vast majority of existing homes sold in June were on the market for less than a month. This indicates some lingering demand for home buying in the midst of a slowing economy and rising rates. Overall, the residential real estate market is slowing, not likely heading into an outright collapse, but some of this outlook hinges on the duration of historic inflationary pressures on home builders from high raw material prices and a tight labor market.

All-Cash Deals Increase as Borrowing Costs Rise

High borrowing costs will likely squelch loan demand as shown in the weekly mortgage data. Mortgage applications are now the lowest since early 2000, so it’s not surprising that all-cash offers will likely stay elevated as mortgage rates spiked this year.

Some cash buyers are most likely investors but also buyers who are moving from higher-priced areas such as the West Coast to lower-priced areas such as the Southeast. The real estate market is still adjusting to the hybrid work environment, giving workers greater flexibility in living arrangements and locations. Regional variations within the NAHB housing metric confirm the suspicion as the West region continues to feel the impact of waning housing demand as workers benefit from flexible working arrangements. As of July, the South region is twelve points ahead of the West, the highest gap since the beginning of the regional index. Given the time required for residential real estate markets to adjust, we may see this housing slowdown phase continue throughout the rest of this year.

Good News for the Federal Reserve

The good news is that various economic metrics show enough stability to handle the Fed’s front-loading tightening cycle. The Conference Board’s index of leading economic indicators for June fell to 117.1. The current index value still stands 4.2 points above June 2019. The economy will most likely take the upcoming Fed rate hike in stride but as the economy becomes more vulnerable, the probability of the Fed breaking something increases as the economy moves into 2023.

For more on the current environment, check out LPL Research’s Econ Market Minute, where Jeffrey Roach, LPL Financial’s Chief Economist, discusses the current state of affairs.